Official Stats

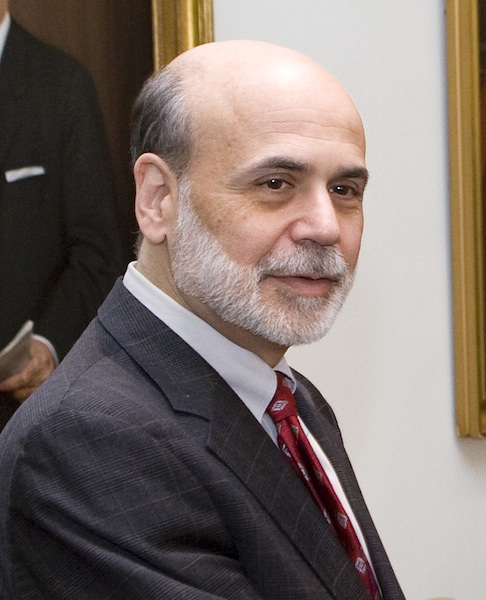

- Official Title: 14th Chairman of the Federal Reserve

- Government: Well-established democracy

- Years Left in Office: 2012; re-appointment possible

- Political Classification:

- Education: BA, PhD Economics

- Age: 72 (born December 13, 1953)

Ben Bernanke Facts and Information

Important Points

- Ben Bernanke has been the head of the US Federal Reserve (the Fed) since 2006

- The Fed controls all major monetary policy for the US

- The Fed main tool for influencing the economy is by setting the interest rates at the central bank

- Bernanke has lowered the US central bank interest rates to zero in order to encourage growth

- Bernanke has also initiated several rounds of quantitative easing to stimulate the economy

The Rundown

Ben “Big Bucks” Bernanke is the main man of monetary policy in the US, the big Kahuna of the bucks, the head of the Fed! Technically the title is “The Chairman of the Board of Governors of the Federal Reserve System” is the head of the central banking system of the United States. Known colloquially as “Chairman of the Fed,” or in market circles “Fed Chairman” or “Fed Chief”. Big Ben has been the Fed Chairman since February 1st, 2006. He was appointed by then-president George W. Bush, and has been battling the impending financial doom in the US ever since. Boy, doesn’t that sound like fun!?!

And another fun fact: Ben’s middle name is Shalom, which means “peace” in Hebrew, as he is Jewish, and takes his faith very seriously. Another key piece of the Bernanke legend is his beard. It adds a touch of elegance to an otherwise average bald guy and stuns people with its looks; if there was a “Beard of the Year” award, Ben “Bearded Wonder” Bernanke would win every year. But let’s get serious about his dude, because, honestly, he holds one of the most powerful positions in the country…and one that in turn affects the entire world economy. So before we go further with the Ben, perhaps its best to look at the Fed first.

The US Federal Reserve—our Central Bank—is one of the country’s most powerful economic institutions in the world because it controls the monetary policy for the largest economy on the planet. What the hell does monetary policy mean anyway? Well, its ‘money’ policy….as in they control the actually US money: the dolla’, dolla’ bills ya’ll! This is not to be confused with fiscal policy which the Congress controls: that’s all about how much money the government spends and takes in, you know, budgets and taxes and stuff. And doesn’t Congress just do a bang-up job with the fiscal policy? Hahahaha…okay enough comedy for know, let’s get back to the monetary policy….

That money policy stuff is the focus of the the Federal Reserve (the Fed), which is the independent central bank established by Congress in 1913. Its primary function is to help maintain the economic soundness of the US economy by setting the interest rates banks charge each other for overnight loans…which in turn affects the rates at all other banks, loan rates, mortgage rates, credit card rates, foreign exchange rates, and even stock and bond trading, By raising or lowering this central interest rate, the Fed can influence how fast or how slow the economy will grow or contract. If they raise the interest rates, it encourages saving; if they lower the rates, it encourages spending.

In addition, the Fed has a few other tools at its disposal: printing, reserving, and loaning. The Fed can juice the economy via ‘injecting‘ money into the system by printing more dollars, although this tactic is not used nearly as much as the general public thinks it is. Much more effective in influencing the supply of money in the system is by raising or lowering the amount of reserves that banks are required to hold in their accounts. In essence, raising reserves means banks have to hold onto more money, which tends to tighten the credit they are willing to extend; lowering required reserves of course have the opposite effect. Lastly, in times of financial crisis, the Federal Reserve is a lender-of-last-resort: it will lend money to failing—but critical—institutions to stabilize the entire financial system.

That last one should ring a bell, right? You remember the “too big to fail” nonsense back when the big recession hit in 2008 that then spurred the Fed to bail out all those crummy banks? I figured you probably did. That was Ben’s work. Oh! That’s right! We were talking about BB! Let’s get back to him now that you know what his job at the Fed is all about….

The big double B! Ben Bernanke is now the dude in charge of all this monetary policy, in one of the most trying periods of US history since the Great Depression. And one smart dude he is: on his SATs, he scored a 1590 out of 1600. Those scores were good enough to land him at Harvard, where he earned a Bachelor’s degree in economics summa cum laude in 1975. He wasn’t done after that, he went to MIT and got his doctorate in economics in 1979. Just when you think the guy is on top of the academic world, he goes and teaches at Stanford for six years. He then became a tenured professor at Princeton, until 2005. He had been serving on the Board of Governors of the Federal Reserve System since 2002.

During that time, he was all about stopping deflation. Ben likes one thing, and that’s the sound of a cash register. He always wants money to be moving around, with plenty of activity in the economy. In 2006, he was appointed to the Federal Reserve Board of Governors for fourteen years, and Chairman for four years. He was reappointed by Barack Obama in 2009 (fun fact, Ben refers to Obama as “Bam-Bam”) and serves to this day in the top slot at the Fed..

Ben takes particular interest in the Great Depression and its causes. He has publishes numerous articles and papers on it. He believes that the Great Depression was caused by Fed making the money supply too small. This is the main reason that Benny B is always ready to fire up a printing press and make some new bills, lower the Fed interest rate, and even lower mandatory reserves at banks….even though that last one is exactly what got so many banks into the current crisis they are in. He has received criticism from all kinds of different people, especially Republicans…many of whom have vowed that he will be fired if they take back the presidency.

All in all though, the system is slowly recovering, and most think that Bernanke is piloting the ship into steady waters with his economic leadership. His “easy-money” policies are showing signs of speeding up the economic rebound three years after he cut Fed interest rates to ZERO. That’s right: nada, nothing, zip. This was done to spur people to use their money elsewhere (stocks, investments, businesses, etc) in order to get the economy hustling again. I mean, why would anyone keep money in the bank, when you earn zero interest on it? Go spend it and make money into more money elsewhere! At least that is what BB has encouraged with his moves at the Fed.

Another economic move by Benjamin to get things in the US humming again is quantitative easing. See, we’ve already covered the tactic of the Fed cutting the interest rates to zero in order to raise the amount of lending and activity in the economy indirectly…but that wasn’t working fast enough for Ben and the gang! When interest rates can go no lower, a central bank’s only option is to pump money into the economy directly. This is referred to as quantitative easing, and Bernanke has as of this writing done 3 rounds of this easing here in the US.

The way the central bank does this is by buying assets—usually financial assets such as government and corporate bonds—with money it has simply created out of thin air…you know, they just printed it! This boosts the cash supply into the coffers of the banks and companies that the Fed has bought into, thus giving those banks and companies the ability and the incentive to lend or expand or invest in the economy in other ways. Make sense? Ben thinks it does…he thinks it makes dollars and sense! Hahahaha…did you see what I did there? Good one, huh?

In summary, Ben “Bankroll” Bernanke is the man. He controls pretty much all of the monetary policy in the United States, and that means he holds the purse strings of the foundational currency of the world. If Ben doesn’t do his job properly, the American dollar would collapse, which would pretty much destroy global financial markets, or at a minimum spark inflation and another deep recession. That’s Ben “Billions” Bernanke for you. If you are interested in BB and his money plays, go follow him on twitter! (@Plaid_Bernanke). But for now, keep the economy on track by going out and spending every cent you have! Make Ben proud!

Posted: Jan 2012